This was the best session I attended at the Direct Marketing Association’s just-concluded annual conference, featuring a CMO from a large insurer and a finance exec with huge experience in retail at Google, with excellent moderation from another healthcare exec. A few takeaways:

Tremendous change in the healthcare industry is underway, and it’s not just because of Obamacare. Used to be insurers could underwrite and consumers had no choice because they got insurance through employers. Now insurers have to accept everybody and consumers can shop around. Over the next 10 years a trillion dollars will shift in the industry as consumers shop around.

Google perspective: Google is where people come when they have concerns about their health. Worried about a diagnosis or a pain, they google it. They have a serious reason for being there and are making a critical decision about their health. 50% of queries now related to healthcare reform. Many queries from mobile devices and about Medicare… so it’s absolutely not true that “people 65+ don’t use the Internet”.

How healthcare is marketed: focus moving to retail. Consumers want self service. Price transparency is not necessarily a bad thing; retailers have known this for 10 years. (Retailers lead the way because their margins are razor thin so they have to be agile.) Insurers are worried about protecting their brand with standard Gold, Silver, Bronze levels. But customers not just interested in lower price, they will pay more for value if you demonstrate it. This is how Nike, Coach, Tiffany maintain a premium price.

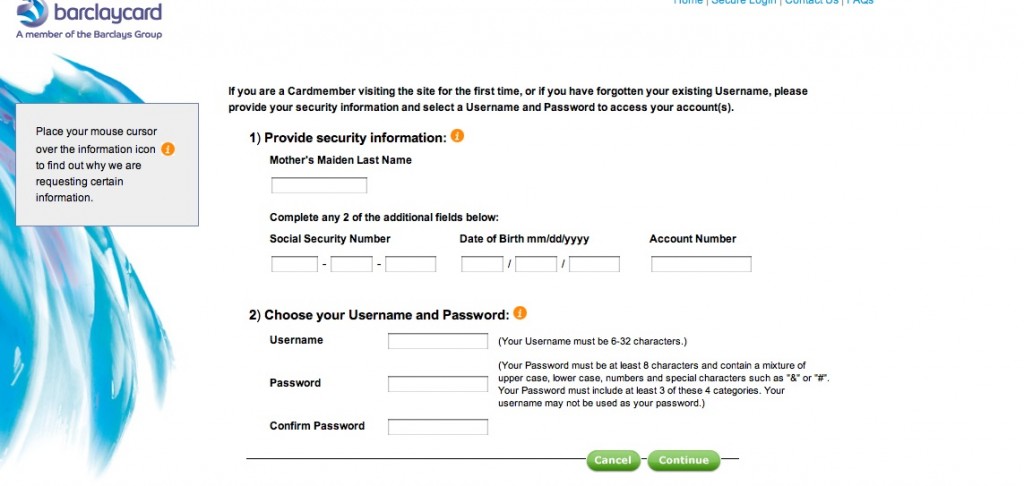

The customer experience: companies need to add a Chief Customer Officer who reports directly to the C suite. Insurers are used to saying no to their customers; we’re in a new era where they need to learn to say yes. Don’t let your org chart show: if the customer goes through a phone tree and they have to answer the same health or personal questions they just answered to a new person, that’s your org chart showing. Customer has to be at the center of your business model, just as they are in retail.

Where should you spend your next dollar as a healthcare marketer? Traditional model was very straightforward: send people a mailer or an agent, they sign up. Now they may get input from a number of places. Most marketers don’t cover the fact that you’re watching an ad then go to Google and search; they don’t have a search strategy combined with their TV buy. Mobile devices a big black hole because there is no equivalent to a cookie to find out how they researched their decision on their phone or tablet, then moved to their computer or the other way round. Gamification may become part of the marketing process: reward people for learning about the health.

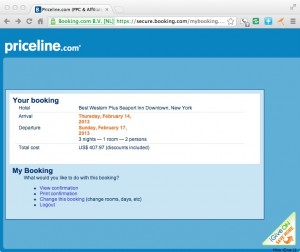

What’s the impact of the startup problems at healthcare.gov and the state exchanges? People assume that the Internet “just works” so this has been a profoundly negative experience. We know from retail that when people experience this kind of “choke point” they don’t return. But ACA is a marathon, not a sprint. The question is how well the government will respond from here.